Bull or bear, it’s all about balance

We are always aiming for ‘optimal’ investment risk, to protect and grow our members’ savings.

02 Mar 2023

It can be difficult to plan for the future, particularly after experiencing several years of ‘unprecedented’ local and global events. Amidst the uncertainty, there’s one thing you can count on, and that’s knowing your CSC investment team is focused on your retirement.

“Our investment team is small, specialised and really laser-focused on delivering all of our members a comfortable retirement outcome,” said Chief Investment Officer, Alison Tarditi.

“CSC members benefit from the deep experience of an investment team that can identify and prioritise high quality investments over trendy ones; withstand pressures to follow the herd—even if that gets uncomfortable for a while; and genuinely assess all of the risks in your portfolio, not just the obvious ones.”

As innovative and disciplined investors, we don’t follow the latest investment fads just because everyone else is doing it. Instead, we seek to continually refine and tailor our investment strategy to reduce the risk of our members’ not achieving their retirement goals.

Ultimately, what matters most when it comes to super is having enough money to sustain a comfortable lifestyle in retirement. Regardless of whether you retire this year or in 30 years’ time, CSC’s members get a reliable outcome from their investment—no matter whether the market is up or down at the time you choose to retire.

“Investment performance that fluctuates between top 10 results in great years and bottom 10 results in bad years makes your retirement date very risky. By prioritising loss prevention and stewarding our portfolio assets conscientiously, we believe the outcomes to all of our members will be superior because they’ll be more dependable,” Ms Tarditi said.

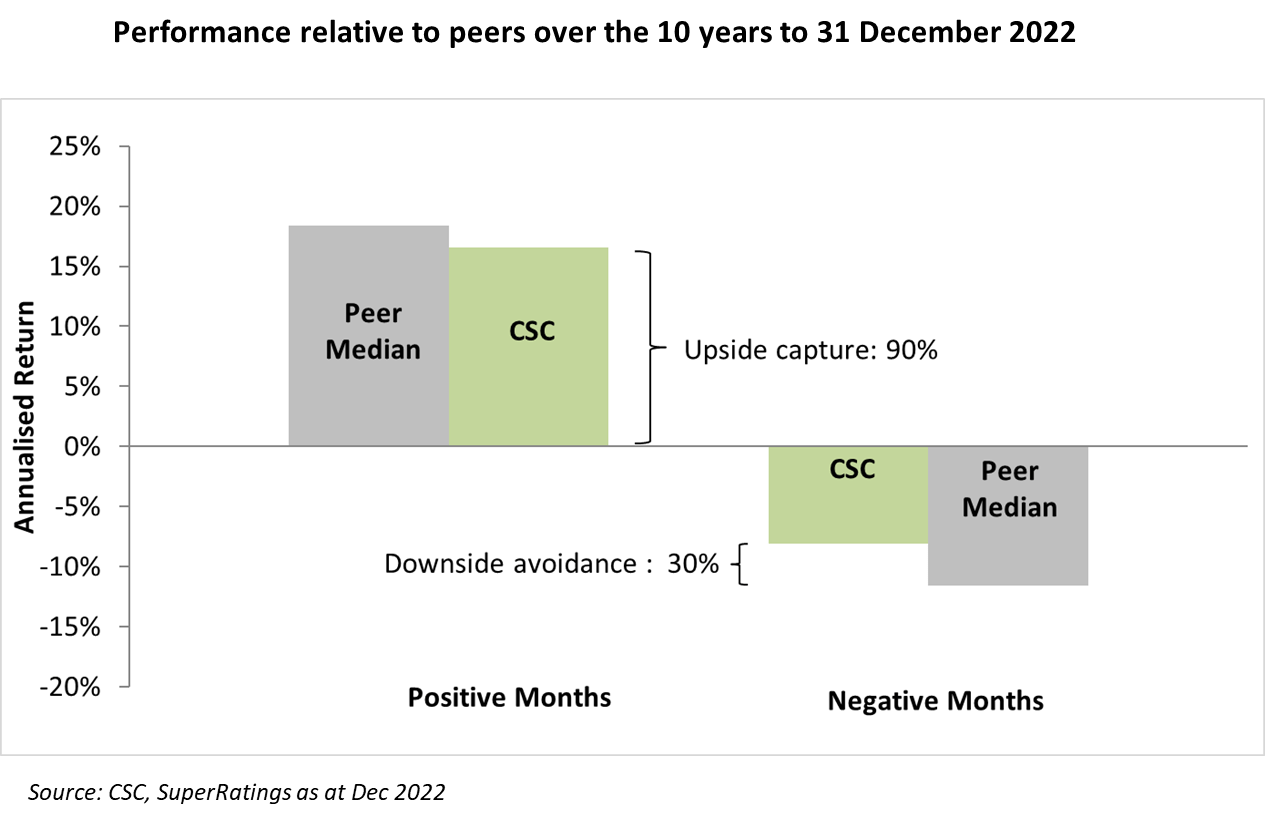

For the past 10 years to 31 December 2022, our default strategy, the PSSap Balanced option captured most (90%) of the gains in strong markets compared to peers , while avoiding 30% of losses in weak markets (e.g. March 2020 at the start of the pandemic, December 2022).

Particularly in times of market uncertainty, CSC’s unwavering focus on risk-adjusted returns, high quality investments, downside avoidance while capturing most of the upside, are what keeps members’ retirement savings solid over the long-term.

Particularly in times of market uncertainty, CSC’s unwavering focus on risk-adjusted returns, high quality investments, downside avoidance while capturing most of the upside, are what keeps members’ retirement savings solid over the long-term.

“The past decade’s increasingly speculative market place has resulted in a wide range of returns for balanced funds. The results of our risk controls are observable consistently in all of our products. Looking at our default product, the PSSap MySuper Balanced option has returned around the median of those available in the market place—strong in absolute return terms at around 7.5% per annum for the 10 years to 31 December 2022, but not the best available.”

“Now, when you consider the risk of losses that our members have to continue to bear in order to achieve those returns by retirement, something that’s independently assessed by Super Ratings, our performance is consistently above that of the median fund.”

| Investment option |

10 yr target Nominal (CPI+) p.a. | 10 yr average returns (p.a.) | Ranking vs Peers Net returns per unit of risk |

|---|---|---|---|

| Aggressive |

7.0% | 9.5% |

#1/41 |

| MySuper (Default) | 6.0% | 7.5% | #9/40 |

| Income-Focused | 4.5% | 5.2% | #1/40 |

“It’s this relative ranking that is the better indicator of the quality and reliability of our members’ investments and thereby their retirement outcomes.” “This discipline requires a strong stomach in more speculative markets where our returns might look less exciting relative to those of others whose risks have yet to surface. Undercompensated risks only become evident when market prices revert to their fundamental values as they're doing right now.”

This distinctive investment approach reflects the needs of our APS and ADF members and was not built to track other industry funds, who have a different membership base with different characteristics.

Our strategy is designed for all of our members’ to have sufficient income when you choose to retire. It’s all about a robust, reliable and sustainable path into the future, focusing on maximising long-term real returns.